Othersuggestive examples against Completeness involve competing notions ofpersonal welfare (see, e.g., Levi 1986; Chang 2002). Must a rationalagent have a defined preference between, say, two career options thatpull in different directions as regards opportunities for creativeself-expression versus community service (perhaps a career as a dancerversus a career as a doctor in remote regions)? Note that some ofthese challenges to EU theory are discussed in more depth in Section 5 below. So under what conditions can a preference relation \(\preceq\) on theset \(\Omega\) be represented as maximising desirability?

In most variants of thisapproach, the underlying alternatives (to which the exclusionarypreferences refer) are possible worlds, represented by maximalconsistent subsets of the language (Rescher 1967, von Wright 1972). However, it has been argued that a more realisticapproach should be based on smaller alternatives that cover all theaspects under consideration – but not all the aspects that mighthave been considered. This approach may be seen as an application ofSimon’s “bounded rationality view” (Simon 1957,196–200). Psychologists also sought to move away from the old psychophysicalassumptions and began seeing mental concepts like preferences withincreased suspicion. Instead, they sought not only to connect andmeasure psychological events, but indeed replace them by thebehavioural criteria with which they were hitherto connected.

Eighty-nine percent of managers surveyed admitted to using intuition to make decisions at least sometimes, and 59% said they used intuition often (Burke & Miller, 1999). Yet when CEOs, financial analysts, and healthcare workers are asked about the critical decisions they make, seldom do they attribute success to luck. To an outside observer, it may seem like they are making guesses as to the course of action to take, but it turns out that they are systematically making decisions using a different model than was earlier suspected. Research on life-or-death decisions made by fire chiefs, pilots, and nurses finds that these experts do not choose among a list of well-thought-out alternatives.

There are two fundamental comparative value concepts, namely“better” (strict preference) and “equal in valueto” (indifference) (Halldén 1957, 10). The relations ofpreference and indifference between alternatives are usually denotedby the symbols ≻ and ∼ or alternatively by P and I. In accordance with a long-standingphilosophical tradition, A≻B is taken to represent “B is worse thanA”, as well as “A is better thanB”. The rational decision-making model has important lessons for decision makers.

- This is avery minimal position on preference criticism, but it has beenquestioned regardless.

- Nevertheless, Lewis’ argument no doubtprovoked an interesting debate about the sorts of connections betweenbelief and desire that EU theory permits.

- To answer thisquestion, one needs to determine both a measurement procedure formeasuring preference intensities and a measurement scale forrepresenting these measurements.

- Hume distinguished reasonfrom the passion, and argued “that reason alone can never be amotive to any action of the will; that it can never oppose passion inthe direction of the will” (Treatise, Book II, PartIII, Section III).

- The value that we assign to obtaining an advantage or disadvantageusually varies with the point in time when we obtain it.

Researchers have found a direct window into the brain systems involved in making every day decisions based on preference. Less formally (and stated in terms of strict preference), the idea isthat if you prefer to stake the prize \(X\) on \(f\) rather than\(f’\), you must consider \(E\) more probable than \(F\). Therefore,you should prefer to stake the prize \(Y\) on \(g\) rather than \(g’\)since the prize itself does not affect the probability of theevents. The above can be taken as a preliminary characterisation of rationalpreference over options. Even this limited characterisation iscontentious, however, and points to divergent interpretations of“preferences over prospects/options”.

1 Property-preferences

Avoting pattern is an assignment of a strategy to eachparticipant, in the form of an n-tuple. The decision procedure concerns a set of alternatives thatsociety has to choose between. In preference-to-choice andchoice-to-choice procedures, the outcome is an element of thatalternative set, or possibly a tie outcome (meaning that no socialchoice was made). In preference-to-preference procedures, the outcomeis a preference relation over the set of alternatives. Some radicalapproaches deny the duality of mental states and argue that some orall preferences are in fact a kind of belief—and hence are opento the same rational criticism that beliefs are. First, it has been claimedthat that desires (standing for motivation in general) arefundamentally distinct from epistemic states in their direction offit.

Some proponents of the criticizability of preferences have referred tosecond-order preferences. An addict may prefer not to prefer smoking;a malevolent person may prefer not to prefer evil actions; an indolentmay prefer not to prefer to shun work; a daydreamer may prefer not toprefer what cannot be realised, etc. First-order preferences arecriticisable if they do not comply with second-order preferences. (Foraccounts of second-order preferences, see Frankfurt 1971, Sen 1977.)Second-order preferences may trigger attempts to change one’spreferences.

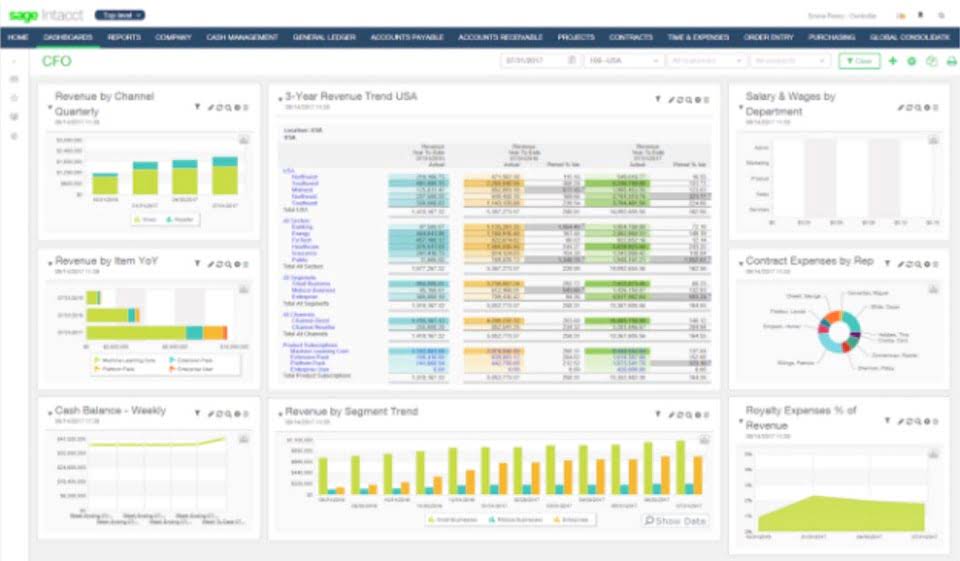

Again, it was an economist, Paul Samuelson, who formulated thisprinciple most explicitly for the concept of preference. In 1938 hesuggested to “start anew … dropping off the last vestigesof the utility analysis” (1938, pp. 61–62). Preferenceswere supposed to be defined in terms of choice, thus eliminatingreference to mental states altogether. Although this approach was highly influential atthe time, economists have largely not followed Samuelson in thisradical proposal (Hausman 2012), and 7 best church accounting software 2020 it might indeed be the case thatSamuelson himself later changed his mind (Hands 2014). With theincreasing convergence of (parts of) economics and psychology, theordinal psychological interpretation of preferences appears tocurrently dominate in these disciplines. However, there is an ongoingdiscussion amongst philosophers whether the current concept ofpreference used by economists is this mental,“folk-theoretic” notion or a separate theoretical concept(Mäki 2000, Ross 2014, Thoma 2021).

When the above holds, we say that there is an expected utilityfunction that represents the agent’s preferences; in otherwords, the agent can be represented as maximising expectedutility. Several authors have argued for a more substantial criticism ofpreferences, including that of intrinsic ones. Some critics argue thatsome or all preferences are in fact a kind of belief, and hence opento the same rational criticism as beliefs. First, it has been claimed thatthat desires (standing for motivation in general) are fundamentallydistinct from epistemic states in their direction of fit.Beliefs are directed to fit the world; hence their insufficient fitprovides the basis for their criticism. Desires are directed to fitthe world to them; hence they lack this basis for criticism (Smith1987). Second, Humeans have argued that treating desires as beliefs isincompatible with Bayesian decision theory and also with other,non-quantitative, decision theories (Lewis 1988, Collins 1991,Byrne/Hajek 1997).

Preference Theory

But there are at least four arguments to the effect thatpeople’s preferences really do change over time. First, manysuccessful explanations of behavioural change have interpreted theempirical behavioural evidence as preference change. Theseexplanations can be differentiated into models of externalinfluences and models of internal coherence. Externalinfluence models attempt to establish general links between externalevents and agents’ preference formations.

3 The von Neumann and Morgenstern (vNM) representation theorem

Changes inblood sugar levels, for example, are correlated to feeding behaviour,sexual behaviour varies with hormonal changes, and many behaviouralpatterns change with increasing age (for references and discussion,see Loewenstein 1996). These correlations are not determinate; each ofthese behavioural changes can be resisted. Hence it is plausible toincorporate these potential physiological effects as visceralpreferences in the general preference framework, and to treat therelevant physiological changes as closely connected with preferencechanges. Can there be rationally justifiable claims that certainintrinsic preferences—i.e.

Decision Theory

Against the temporal neutrality of preferences, some have argued thatthere is no enduring, irreducible entity over time to whom all futureutility can be ascribed; they deny that all parts of one’sfuture are equally parts of oneself (Parfit 1984). Theyargue, instead, that a person is a succession of overlapping selvesrelated to varying degrees by memories, physical continuities, andsimilarities of character and interests, etc. By this view, it may bejust as rational to discount one’s “own” futurepreferences, as to discount the preferences of another distinctindividual, because the divisions between the stages of one’slife may be as “deep” as the distinctions betweenindividuals. For some—but only some—types of goods, improvingsequences of outcomes are preferred to declining sequences. For instance, many would prefer an increasing rather than a decreasing living standard across their work life. These areall patterns that cannot be handled in the bifactorial model with itsobject-independent time preferences (Loewenstein et al 2002).

The notion of preference has a central role in many disciplines,including moral philosophy and decision theory. Preferences and theirlogical properties also have a central role in rational choice theory,a subject that in its turn permeates modern economics, as well asother branches of formalized social science. The notion of preferenceand the way it is analysed vary https://www.wave-accounting.net/ between these disciplines. A treatmentis still lacking that takes into account the needs of all usages andtries to combine them in a unified approach. This entry surveys themost important philosophical uses of the preference concept andinvestigates their compatibilities and conflicts. In a votingprocedure, the inputs are the votes of the individual participants.

Two major attempts have been made to define the principal monadicpredicates “good” and “bad” in terms of thepreference relation. One of these defines “good” as“better than its negation” and “bad” as“worse than its negation” (Brogan 1919). Thus, if \(\succcurlyeq\) satisfies transitivity then \(\succ\) and \(\sim\)are also transitive, and furthermore, IP-transitivity, PI-transitivityand acyclicity hold. Preference aggregation and social decision processes were studiedalready in the 18th century. Last, another type of formation rule considers one alternative atleast as good as another if it is strictly preferred according to themost relevant aspect, and in case of a tie, according to thenext relevant aspect. There is a strong tradition, particularly in economics, to equatepreference with choice.

Preference Decisions – Definition and Explanation:

This is what happens when people involved innegotiations or discussions approach each other’s views in ways thatmake their preference relations less conflicting. The Delphi method isa systematized procedure that can be used to reduce interindividualdifferences in preferences. On an intraindividual level, strivings fora reflective equilibrium can take the form of adjusting preferencerelations that concern different aspects of an issue to eachother. From a psychological point of view, such changes can bedescribed as reductions of cognitive dissonance in value issues.

Then if \(g\) is weakly preferred to \(f\), \(g’\) must be weaklypreferred to \(f’\). Thenit seems perfectly reasonable to prefer \(g\) over \(f\) but \(f’\)over \(g’\). Preference decisions relate to selecting from among several competing courses of action. To illustrate, a firm may be considering several different machines to replace an existing machine on the assembly line.

Most formal studies in this area have beendevoted to preference-to-preference or preference-to-choicecombinations, that are assumed to represent both joint decisions(voting) and decisions based on individual wishes. However, in theinterpretation of formal results in this area, these distinctions canbe essential. In contrast, a voting procedure does not consist in combining thepreferences of the participants. The objects of combinations are votes,that in most voting systems take the form of opting for one of thealternatives under consideration. (Of course, individuals can beexpected to vote in a way that reflects their preferences, but it isnevertheless the votes, not the preferences, that areinputs into the voting procedure.) Therefore, it is more adequate torepresent voting as a choice-to-choice procedure.